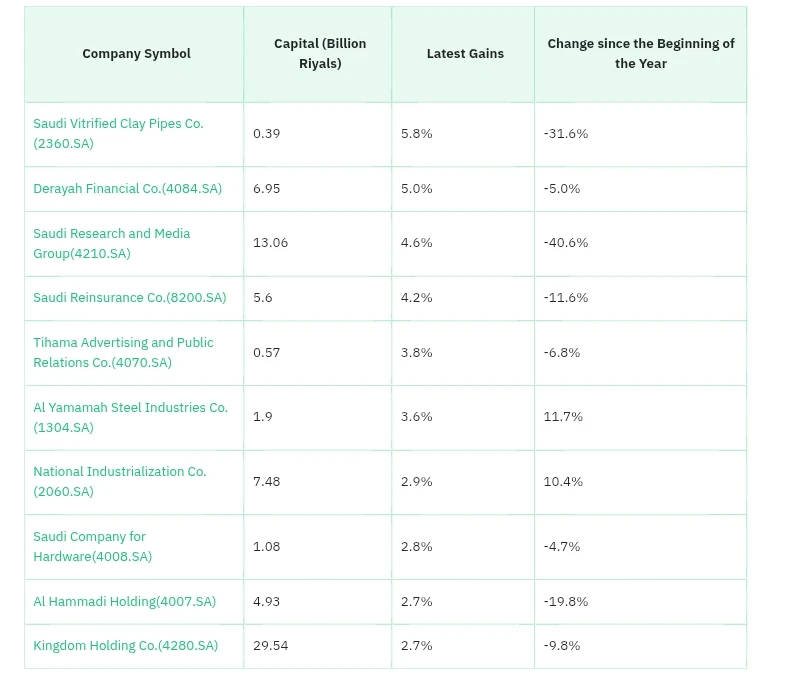

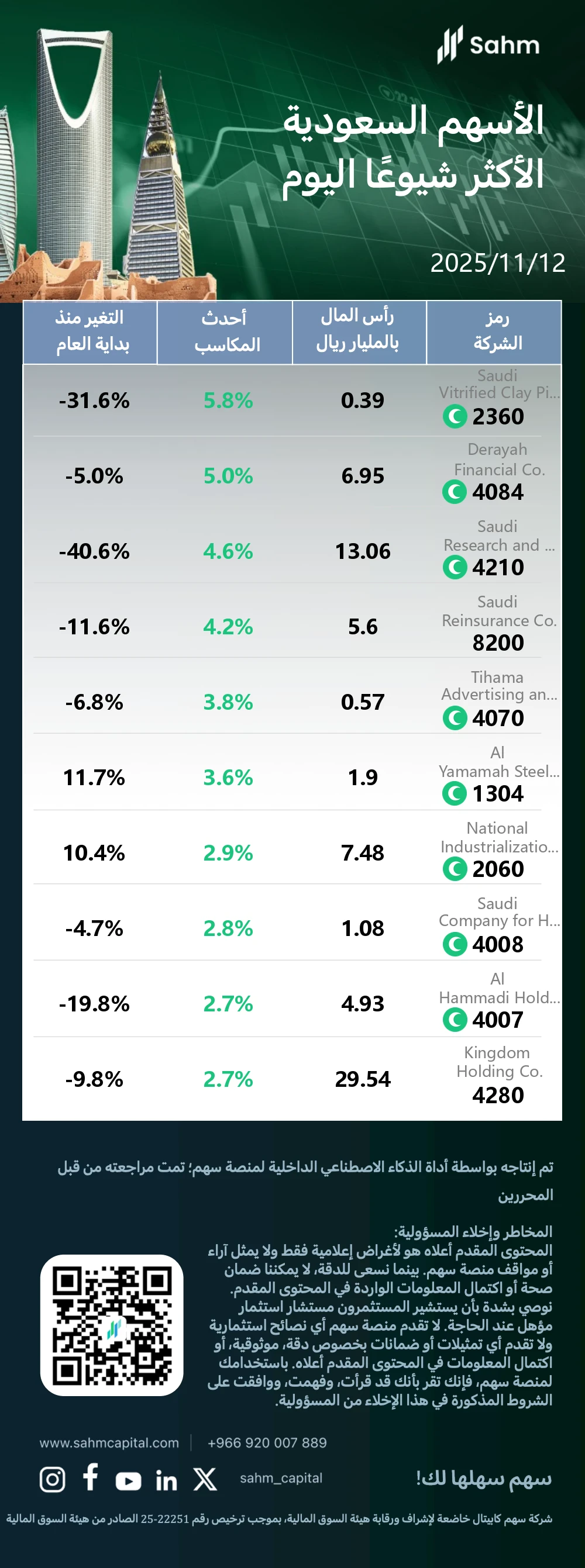

Keeping the essential elements - the company name, stock performance, and main catalysts

Editor's Note: the "Trending Saudi Stocks" column tracks the day's top bullish stocks in the KSA market,

aiding investors in promptly identifying opportunities for potential gains.

At the close of 12/11/2025, the Tadawul All Shares Index dropped by 0.14%, closing at 11254.88 points; the Parallel Market Capped Index rose by 0.18%, closing at 24136.51 points. Sahm has compiled the Top 10 Daily Stock Price Gainers in the KSA market.

Saudi Vitrified Clay Pipes Co.: The daily gain is 5.8%, reports Q3 profit and plans rights issue to raise capital.

Saudi Vitrified Clay Pipes (SVCP) is a publicly traded company listed on the Saudi Stock Exchange (Tadawul) since 2007. Operating in the Capital Goods sector, SVCP specializes in industrial machinery. The company, founded in 1978, is headquartered in Riyadh, Saudi Arabia. SVCP's primary business focus is the manufacturing and distribution of vitrified clay pipes.

In a noteworthy development, the possible reasons for the stock price increase of 2360.SA (Saudi Vitrified Clay Pipes Co.) may be: 1. The company's Q3 2025 financial turnaround, reporting a net profit of 10.66 million Saudi Riyals compared to a loss in the same period last year. 2. Significant improvement in financial performance, with a 87.08% reduction in net loss for the first 9 months of 2025. 3. Revenue growth of 8.809% year-on-year for the first 9 months of 2025, reaching 44.59 million Saudi Riyals. 4. Other income of 21.83 million Riyals from the sale of the second factory, contributing to the profit. 5. Reduction in accumulated losses to 38% of capital, down from 45.45% in June. 6. Planned rights issue to support growth strategy and strengthen financial position. 7. Increased trading volume, up 556.69% to 245,515 shares, significantly higher than the 3-month average.

Derayah Financial Co.: The daily gain is 5.0%, Experiences brief upturn amid market volatility, showing resilience in fluctuating conditions.

In a noteworthy development, the possible reason for the stock price increase of 4084.SA (Derayah Financial Co.) may be attributed to a short-term market rebound. The 5.0% daily gain comes against the backdrop of a 5.0% year-to-date decline, suggesting a potential recovery from recent losses. This uptick could reflect improved investor sentiment or sector-wide positive momentum in Saudi Arabia's financial services industry. Daily market fluctuations and broader economic factors in the Saudi market may also be contributing to the stock's performance.

Saudi Research and Media Group: The daily gain is 4.6%, stock rises, reversing year-to-date losses amid market optimism.

SRMG, a publicly traded entity on the Saudi Stock Exchange since 2006, operates in the media sector with a focus on publishing. Headquartered in Riyadh, Saudi Arabia, the company was founded in July 2000. As a key player in the regional media landscape, SRMG continues to expand its portfolio and influence in the publishing industry.

In a noteworthy development, the possible reason for the stock price increase of 4210.SA (Saudi Research and Media Group) may be a technical rebound after a significant year-to-date decline. The stock surged 4.6% in a single day, despite a substantial 40.6% drop since the beginning of the year. This sharp uptick could indicate that investors perceive the stock as oversold and undervalued, prompting renewed buying interest. The media group's shares may also be benefiting from broader market recovery trends or sector-specific positive developments in the Saudi Arabian media industry.

Saudi Research and Media Group: The daily gain is 4.6%, stock rises, reversing year-to-date losses amid market optimism.

SRMG, a publicly traded entity on the Saudi Stock Exchange since 2006, operates in the media sector with a focus on publishing. Headquartered in Riyadh, Saudi Arabia, the company was founded in July 2000. As a key player in the regional media landscape, SRMG continues to expand its portfolio and influence in the publishing industry.

In a noteworthy development, the possible reason for the stock price increase of 4210.SA (Saudi Research and Media Group) may be a technical rebound after a significant year-to-date decline. The stock surged 4.6% in a single day, despite a substantial 40.6% drop since the beginning of the year. This sharp uptick could indicate that investors perceive the stock as oversold and undervalued, prompting renewed buying interest. The media group's shares may also be benefiting from broader market recovery trends or sector-specific positive developments in the Saudi Arabian media industry.

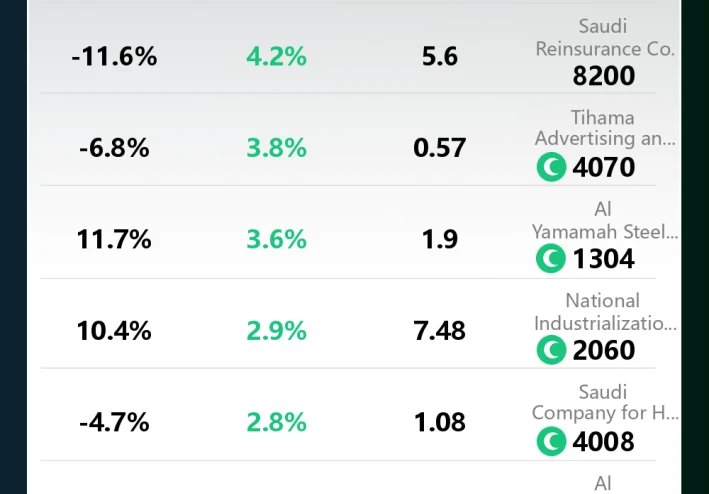

Saudi Reinsurance Co.: The daily gain is 4.2%, stock rebounds. Possible factors: market optimism, improved financials, sector growth.

Saudi Reinsurance Co., operating under the name SAUDI RE, is a publicly traded entity listed on the Saudi Stock Exchange (Tadawul) since 2008. The company specializes in reinsurance services within the insurance sector. Headquartered in Riyadh, Saudi Arabia, SAUDI RE was founded in May 2008 and has since established itself as a significant player in the regional reinsurance market.

In a noteworthy development, the possible reason for the stock price increase of 8200.SA (Saudi Reinsurance Co.) may be a technical rebound following its 11.6% year-to-date decline. The 4.2% daily gain could indicate renewed investor interest, potentially driven by value-seeking strategies. Market sentiment in the Saudi insurance sector may have improved, contributing to the stock's upward movement. Additionally, the company might have released positive financial results or announced favorable business developments, attracting buyers. Broader economic factors or regulatory changes in Saudi Arabia's insurance industry could also be influencing investor confidence in Saudi Re.

Tihama Advertising and Public Relations Co.: The daily gain is 3.8%, Stock surge reflects market trends and sector growth in Saudi Arabia.

Tihama Advertising and Public Relations Co (TAPRCO) is a publicly traded entity on the Saudi Stock Exchange (Tadawul) since 1993. Operating in the media sector with a focus on advertising, TAPRCO has been a prominent player in the industry since its establishment in 1983. The company is headquartered in Riyadh, Saudi Arabia, and continues to be a significant presence in the regional advertising and public relations landscape.

In a noteworthy development, the possible reason for the stock price increase of 4070.SA (Tihama Advertising and Public Relations Co.) may be a combination of short-term market dynamics and potential sector-specific factors. The 3.8% daily gain could indicate a temporary rebound or positive sentiment shift towards the company. However, the year-to-date performance of -6.8% suggests that this uptick may be part of a broader recovery trend. Investors might be reassessing the value proposition of Tihama within the Saudi advertising and public relations sector, potentially driven by improved industry outlook or company-specific developments.

Al Yamamah Steel Industries Co.: The daily gain is 3.6%, wins $47M contract for Saudi power project, boosting its market position.

Al Yamamah Steel Industries, a publicly traded entity on the Saudi Stock Exchange (Tadawul) since May 2016, operates in the materials sector with a focus on steel production. Headquartered in Riyadh, Saudi Arabia, the company was founded in January 1989. It has established itself as a significant player in the steel industry within the Kingdom.

In a noteworthy development, the possible reason for the stock price increase of 1304.SA (Al Yamamah Steel Industries Co.) may be attributed to a significant new contract and positive business outlook. The company recently secured a 176.48 million Saudi Riyal (approximately $47 million) contract with Arabian Electrical Transmission Line Construction Co. Ltd. to supply steel towers for a 380kV ultra-high voltage transmission line project in western Saudi Arabia. This contract, along with two previous contracts worth 207 million Saudi Riyals signed in October, demonstrates the company's strong market position. The anticipated financial impact from 2026 Q2 onwards has likely boosted investor confidence, resulting in a 3.6% daily gain and an 11.7% year-to-date increase in stock price.

National Industrialization Co.: The daily gain is 2.9%, reports 289% profit increase in Q3 2025, surpassing expectations.

National Industrialization Co (TASNEE) is a publicly traded industrial conglomerate based in Riyadh, Saudi Arabia. Established in May 1985, it has been listed on the Saudi Stock Exchange (Tadawul) since January 1993. The company operates within the Capital Goods sector, focusing on diversified industrial activities. TASNEE plays a significant role in Saudi Arabia's industrial landscape.

In a noteworthy development, the possible reason for the stock price increase of 2060.SA (National Industrialization Co.) may be attributed to its robust financial performance in the first nine months of 2025. The company reported a significant 288.96% year-on-year increase in net profit, reaching 271.5 million Saudi Riyals. Additionally, earnings per share rose to 0.41 Saudi Riyals, up from 0.10 Saudi Riyals in the same period last year. Despite a 9.52% decline in revenue, the substantial profit growth suggests improved operational efficiency. The stock's 10.4% year-to-date gain reflects positive investor sentiment, while the recent 2.9% daily increase indicates ongoing market confidence in the company's prospects.

Saudi Company for Hardware: The daily gain is 2.8%, reports massive 538% profit increase in Q3 2025, surpassing market expectations.

Saco, a publicly traded company listed on Tadawul since May 2015, operates in the specialty retail sector. Headquartered in Riyadh, Saudi Arabia, the firm was founded in November 1984. It specializes in hardware retailing, offering a wide range of products to meet consumer and professional needs in the Saudi market. Saco's business model focuses on providing high-quality hardware and related items through its retail network.

In a noteworthy development, the possible reason for the stock price increase of 4008.SA (Saudi Company for Hardware) may be its impressive financial turnaround. The company reported a significant net profit of 39.36 million Saudi Riyals in Q3 2025, marking a 538.25% year-on-year increase and a 674.73% quarter-on-quarter growth. This remarkable performance, transforming a loss of 8.98 million Saudi Riyals in Q3 2024 into a substantial profit, likely boosted investor confidence. The 2.8% daily price increase reflects positive market sentiment, despite the stock's 4.7% year-to-date decline. With a current market capitalization of 10.8 billion Saudi Riyals, investors may view the stock as potentially undervalued given its recent financial achievements.

Kingdom Holding Co.: The daily gain is 2.7%, posts robust Q3 2025 profit growth, exceeding market expectations.

Kingdom Holding Co, a public entity listed on Tadawul since 2007, operates in the Diversified Financials sector with a focus on Multi-Sector Holdings. Established in 1996 and headquartered in Riyadh, Saudi Arabia, the company has maintained a significant presence in the financial landscape for over two decades, diversifying its portfolio across various sectors.

In a noteworthy development, the possible reason for the stock price increase of 4280.SA (Kingdom Holding Co.) may be attributed to the company's robust financial performance in 2025. The firm reported a significant 128.92% year-on-year increase in third-quarter net profit, reaching 794.51 million Saudi Riyals. Additionally, Kingdom Holding's nine-month net profit for 2025 rose by 39.72% to 1.63 billion Saudi Riyals, while revenue grew by 9.09% to 1.98 billion Saudi Riyals. The company's earnings per share for the first nine months of 2025 improved to 0.44 Saudi Riyals from 0.32 Saudi Riyals in the previous year. These positive financial results, coupled with gains from strategic investments and improvements in the hotel business, likely contributed to the 2.7% stock price increase on the day.

Al Hammadi Holding: The daily gain is 2.7%, to implement new dividend policy from Q3 2025, aiming to enhance shareholder returns.

Al Hammadi Holding, a public entity listed on the Saudi Stock Exchange (Tadawul) since July 2014, operates in the Health Care Equipment and Services sector. The company, founded in November 1985 and headquartered in Riyadh, Saudi Arabia, specializes in health care facilities. It has established itself as a significant player in the Saudi healthcare industry.

In a noteworthy development, the possible reason for the stock price increase of 4007.SA (Al Hammadi Holding) may be attributed to the company's announcement of a new dividend policy. The Saudi healthcare provider committed to distributing at least 60% of its quarterly net profit as dividends for the next four years, starting from Q3 2025. This move, coupled with the board's approval of a 0.20 Saudi Riyal per share dividend for Q3 2025, appears to have boosted investor confidence. The company's Q3 financial performance, with a net profit of 51.89 million Saudi Riyals and sales of 294.91 million Saudi Riyals, may have also contributed to the positive sentiment. Despite a 19.8% year-to-date decline, the 2.7% daily gain suggests renewed investor interest in Al Hammadi Holding's long-term prospect.